More reasons to give

ReAD about the special Domestic violence shelter tax credit.

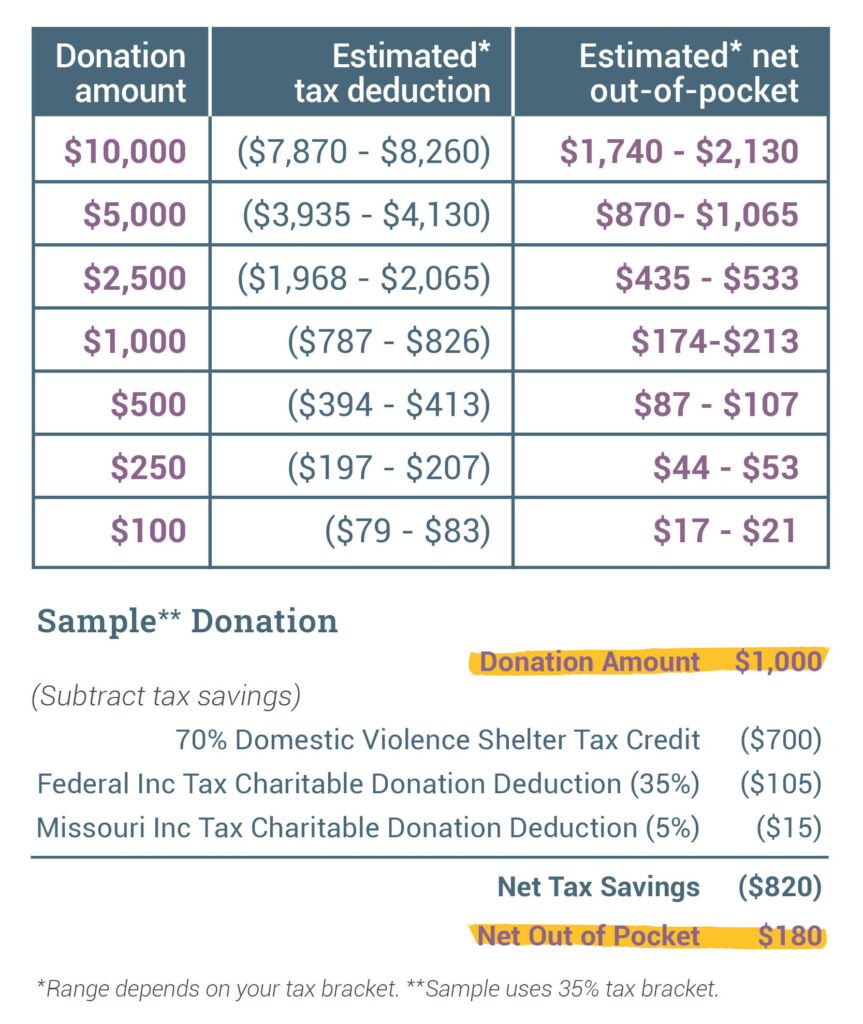

Any gift of $100 or more qualifies for a 70% Missouri Domestic Violence Shelter Tax Credit! For instance, donate $500 and your net out-of-pocket for the donation could be only $86 – $106.* That is one more big reason to donate this year!

Have you made a qualifying gift of $100 or more this year? Thank you!

Here are your next steps:

1. Fill out the first page of the 2024 DV Tax Credit Form (below) and hand-sign it.

2. Mail the original hand-signed application by January 26 to the following address:

- Newhouse | c/o Chris Stibbs | PO Box 240019 | Kansas City, MO 61124

- Please email chris@newhousekc.org to let us know that you mailed it and we can watch for it.

Once the application is received here, we will sign it and send it off to the government. All applications need to be in the hands of the government by February 2, 2025 to guarantee your letter will arrive to you before the tax deadline. That is why it is very important to mail your application to us by January 26, 2025.

Note: We encourage all potential donors to consult their tax advisor for more detailed information.

Questions? Email Chris at chris@newhousekc.org.

Thank you for supporting survivors of domestic violence in KC!